We use cookies to give you the best possible experience. To accept cookies continue browsing, or view our Cookies Policy to find out more.

Hokodo Payment Frequently Asked Questions

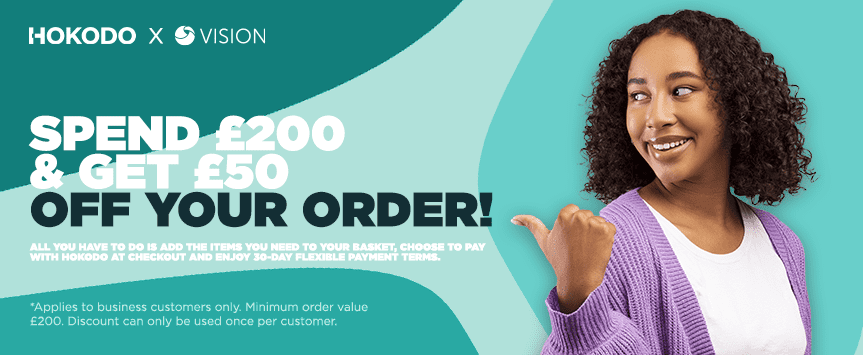

Choose to pay in 30 days, interest free on your Vision Linens order with Hokodo.

We’ve teamed up with Hokodo in order to bring you deferred online payment plans and a seamless checkout experience on business purchases.

How Hokodo works

- Fill your basket

Shop for the items you need, and remember that you won’t need to pay for them upfront. - Head to the checkout

When you’re ready to finish your order, head to the checkout. - Choose to pay in 30 days, interest free with Hokodo

Select from the payment options that you are eligible for and choose your payment method. - Receive your goods

We’ll dispatch your order immediately while you’ll have the freedom to delay your payment by up to 30 days (end of month).

How Hokodo benefits you

Get what you need, when your business needs it

Gone are the days of prioritising other purchases over your linen purchases and missing out on profits because you don’t have the right materials or stock.

Purchase what you need, when you need it, and delay payment by up to 30 days (end of month).

Sell more and grow your business

By choosing to pay in 30 days, interest free will help to improve your cash flow, so you can focus on what really matters: looking after your guests and growing your business

No hidden fees

When you delay your payment with Hokodo, there’s no extra charges or hidden fees. You’ll get a tailored credit limit and payment plan options based on your business type and financial history.

FAQs

What is your online business payment option?

Pay in 30 days, interest free lets you purchase and receive the stock or materials you need for your business, without having to pay any of the costs for up to 30 days (end of month).

What is Hokodo?

Hokodo is a digital payments company and Europe’s leading provider of online B2B e-commerce payment solutions. By partnering with Hokodo, we are able to offer payment terms to the majority of our business customers, while protecting all parties from risk.

So, it’s like Klarna or Clearpay for B2B?

Yes! It’s a very similar concept.

How long will I have to wait for approval?

Most of the time, Hokodo can approve your business for payment terms in less than a second. Occasionally, when a manual review is required, it can take longer.

How do you determine my credit limit and payment terms?

We use the name and address of your business to conduct a credit and fraud risk assessment, using a range of sources including Companies House. This does not impact your credit score.

Does Hokodo affect my credit score?

Our credit and fraud checks do not impact your credit score. If your invoices are paid on time, your credit score will not be affected.

How can I pay for my order?

You can pay for your purchases using your usual method, such as credit card or direct debit.

Will I receive a reminder email when my payment is due?

Yes, you will receive a reminder email 3 days before your payment due date, informing you that you will be charged (by your chosen payment method) in 3 days time.

Can I settle my outstanding payment earlier than the date set out in my payment terms?

Yes, you can settle your payments early by card or bank transfer. Contact support@hokodo.co and our customer support associate will provide you with the details you need to do this.

What happens if I don’t pay my invoices in time?

Once your invoice is past its due date, Hokodo will begin the dunning process. They will attempt to contact you by email and telephone. If necessary, a collections agency will become involved.

Which countries can Hokodo’s payment plans be accessed in?

Currently, Hokodo’s payment plans can be accessed by buyers in the UK, France, Belgium, the Netherlands, Germany and Spain.

Do I need to sign up to use Hokodo?

No, you can use Hokodo via your account with visionlinens.com. You don’t need to take any action before selecting your payment terms at checkout.

What’s the maximum amount I can spend on one transaction with Hokodo?

We can extend instant business credit terms on orders up to the value of £20,000 or €25,000. Above that, Hokodo’s credit analysts will need to run a manual review.

Can I pay in instalments?

Currently, Hokodo does not offer instalment payment plans.

Can I place an order using Hokodo one day, and then place another order a few days later with Hokodo?

You can place as many business orders as you like using our solution, provided you do not exceed the credit limit of your account and keep up with any due payments.

Can I still access Hokodo’s solution if I am behind on my payments?

No. We will not allow business customers with unpaid invoices to place any new orders until their debt has been cleared.

Why am I not currently eligible for Hokodo’s payment solution and how can I become eligible?

Your eligibility depends on several factors that revolve around your business's credit worthiness and purchasing behaviour. Hokodo analyses your company, transactions and payment history in order to determine eligibility, and unfortunately if certain criteria are not met, we cannot offer you a payment solution.

That said, by continually paying on time upfront directly to the merchant, you are increasing your chances of being offered this payment option in the future.

What are the full terms and conditions for payment through Hokodo?

You can find full payment terms and conditions over on Hokodo's website through this link.